1. Owning a Property Together in Cayman

Be it purchasing your first home with a loved one, or your tenth property with a business partner, buying a property with someone is an exciting moment.

However, amongst all the excitement, there is also a great level of responsibility that comes with jointly owning property. It is essential that you hold the property in a way that best suits your circumstance in order to avoid a potentially complex legal situation. There are two ways in which you can own property together in the Cayman Islands; as Joint Proprietors or as Proprietors in Common.

This is a very important decision as the way in which you co-own property may have implications for couples who later separate or investors, family or friends who pool resources to buy property together.

2. Joint Proprietors vs. Proprietors in Common

Joint Proprietors

As Joint Proprietors, each co-owner holds an equal interest in the property i.e. you both own it equally. Should one of you pass away, your interest automatically passes to the remaining co-owner(s). This will occur without the need to obtain Probate.

Married couples generally opt to own their property as Joint Proprietors. However, this approach isn't the only option available. Married couples can also choose to own property as Proprietors in Common.

Proprietors in Common

Taking the Proprietors in Common route means that each co-owner, in this case a Married couple, owns a specific share or percentage of the property. A variety of options exist e.g. 50/50, 70/30, 90/10. If the property is ever sold, the co-owners would receive the monetary equivalent of their share from the sale proceeds e.g. if the property sells for US$500,000 and you have a 70% share, you would receive US$350,000.

Should a spouse or co-owner pass away, that share will pass to the Beneficiary(s) named in the Will (or under the Rules of Intestacy if there is no Will). In other words, your share can go to whomever you wish (it does not have to go to the other co- owner(s).)

Unmarried couples, couples in a second marriage, business partners and those who have made unequal contributions to the deposit and/or repayments are advised to hold their property as Proprietors in Common.

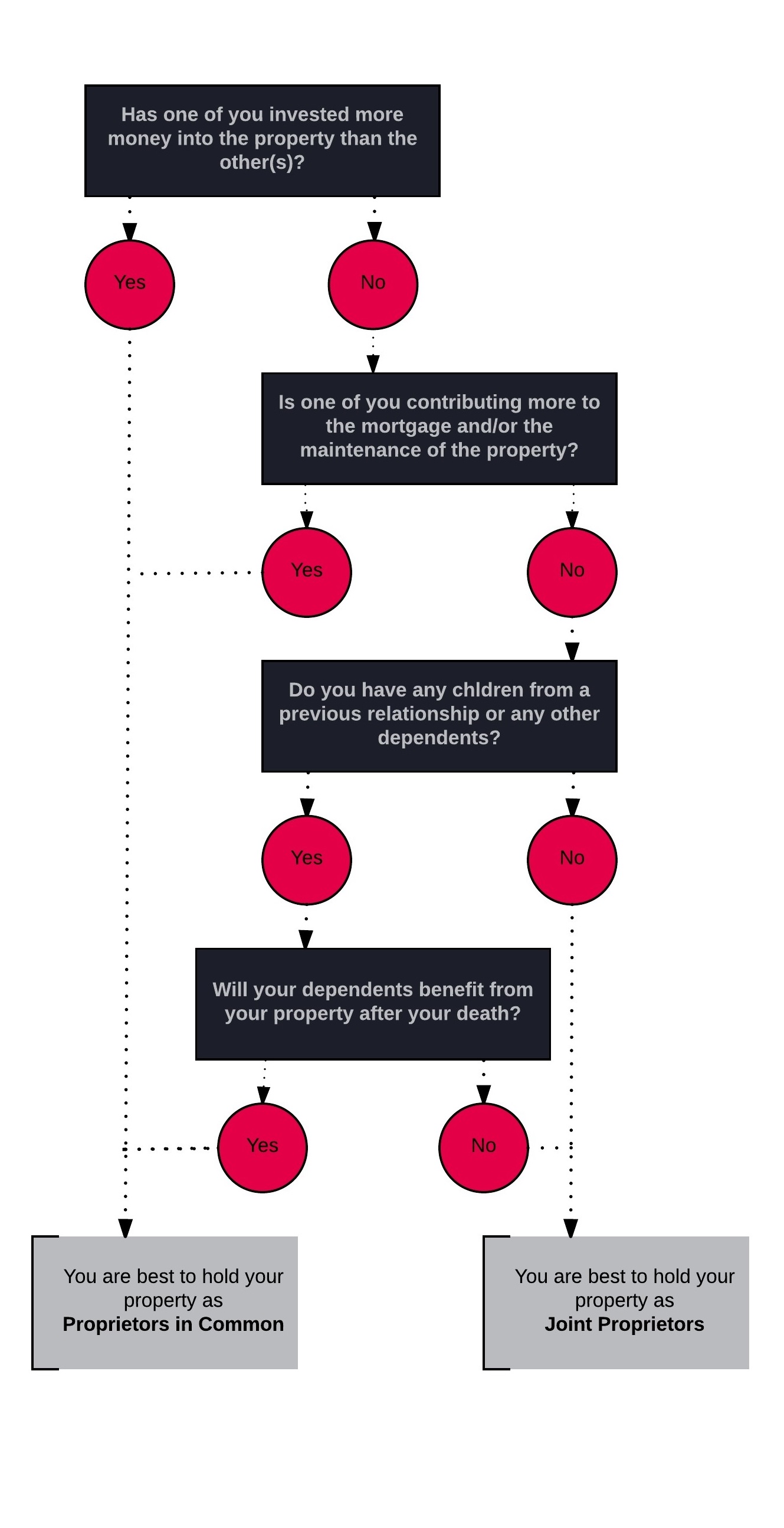

It is important that your property is held in a way that is most appropriate and effective for you. If you have any uncertainty about what is best for you, review this series of questions designed to help you determine if it would be most beneficial for you as Joint Proprietors or as Proprietors in Common.

3. Declaration of Trust

Now that you have decided on how your co-owned property will be held, it's time to put together a Declaration of Trust. This is a legally binding document which clearly outlines what you each own and how the value of the property would be divided should you ever separate or sell the property.

A Declaration of Trust records what each owner has contributed to the property, including the initial deposit needed for the property, the mortgage repayments and/or the financial maintenance of the property. It is therefore an incredibly important document in instances when one owner has invested more in the property than the other.

Without a Declaration of Trust, co-owners could potentially face a highly complex and unpleasant legal situation. If you fail to itemise and detail your individual stakes in the property and then later disagree on how things should be distributed, you may experience a very expensive and lengthy court case to sort it out.

In addition to a Declaration of Trust, we also advise all our clients co-owning property to have a co-habitation agreement, regardless of marital status. This agreement covers who is responsible for what, including bills, living expenses, furniture and maintenance.

4. Wills and Estate Planning

After buying a property, the next logical step is to prepare a Will, especially if you have chosen to hold your property as Proprietors in Common in order to specify who you wish to inherit your property after your death. If you own shares or have an interest in a Cayman Islands company or fund then you should also consider writing a Cayman Islands Will.

Wills and Estate Planning can be an unpleasant and morbid process, but it plays a central role in protecting your wealth, much of which is likely to now be wrapped up in your new property. Without a Will, a family member or intended beneficiary carries the burden of extra costs, extended paperwork and greater legal obligations. Preparing a Will helps to ensure the financial future of your family.

We are experts in finding solutions for individuals, business owners and families who want to safeguard their estate and ensure their loved ones are protected.

Working with our local clients, we help them to use trusts to own their businesses, homes, and other assets and to take advantage of some of these benefits. Trusts are often used in conjunction with Wills, together forming the basis of the client’s estate plan and they have particular advantages in the Cayman Islands in terms of asset protection and avoiding probate.

By placing your needs at the centre of our service, you and your family will benefit from a highly comprehensive, tailor-made Will which reflects your situation, objectives and addresses any challenges arising from your circumstances.

5. Frequently Asked Questions

We are keenly aware that all of this information can be overwhelming and it may have raised mainy questions for you. Our team is available to discuss this guide and answer any questions that you may have.

There are some questions that we regularly receive from clients, we've answered them below and hope that this guide has been helpful.

I am married, how should my spouse and I hold our property?

Married couples or civil partners generally choose to hold their property as Joint Proprietors. This is usually because they will want their partner to receive their share of the property if they were to pass away.

This is not compulsory though. If one partner has contributed more to the property or have children from a previous relationship, they may prefer to hold the property as Proprietors in Common instead.

I’ve have children from a previous relationship, and I would like to pass on my share of the property to them. What should I do?

If you and/or your current partner have children from a past relationship, it would be best to hold your property as Proprietors in Common. This will allow you to leave your share to your children or anyone you wish. You will also need to prepare a Will which specifically names beneficiaries.

In this situation, we also advise that you prepare a Declaration of Trust. A Declaration of Trust outlines each co-owners individual stake in the property so your children will inherit the right amount. It can also stipulate whether the surviving partner has the right to continue to live in the property until they pass away or wish to sell. Without this in place, your partner may be forced to sell the property in order to give your children their inheritance.

I've invested more in the property than my spose/the co-owner. What should I do?

Joint Proprietors have an equal interest in the property. This means if you seperate and wish to sell, you will both get an equal share of the proceeds. Whilst it is understandable to think you will never find yourself in this situation, it is important to consider all possible outcomes and only you can decide if you would be happy with splitting everything 50/50.

If not, it is best to hold the property as Proprietors in Common and agree now, at a more amicable time, what your shares in the property will be. It is also advisable that you set up a Declaration of Trust as it can outline in what way a co-owner can change the agreement in the future.

What if one of us is in financial trouble?

If either of you are in financial difficulties, or expect to be in the near future, you should take advice from an experienced financial adviser before buying property together.

However if you decide to go ahead, it is likely a Proprietors in Common agreement would be the better option for you both. Holding property as Proprietors in Common means only the share of the co-owner in financial trouble can then be actioned against by any creditors.

I want to hold the property as Joint Proprietors but my partner wants to hold it as Proprietors in Common. How do we decide?

This is a very personal decision and is something that you will have to agree to on your own.

It is a very important decision and one that neither partner should feel forced into compromising. If you unable to make the choice, we would suggest that you both seek independent legal advice. You should also think very carefully about whether you want to buy the property together at all.

A relative is helping us pay for the property. We are all planning to live together. What should we do?

All parties involved in this arrangement will need to ensure that their interests are protected. We recommend that everything is agreed and recorded ahead of the purchase to prevent any future disputes. It is advisable that the property is held as Proprietors in Common and that a Declaration of Trust is drafted to record your relative’s rights over the property.

If we seperate, will the property automatically be sold?

If you are married the relevant Court will decide what happens to your property.

If you are not married, and one of you applies to the Court, the Court will order a sale (subject to the Court being satisfied that it is appropriate to do so). If there is good reason for not doing so (e.g. because of young children), the Court may order the sale to be delayed. If you have a Declaration of Trust that restricts the power of sale, the Court will consider this also.

Can we change our status of being Joint Proprietors or Proprietors in Common?

If you are Joint Proprietors, you can jointly decide to end the Joint ownership and create a Proprietors in Common whenever you wish by filing a RL18 Form with Lands & Survey. You should take advice if you plan to do this as once the notice is given, all automatic rights, such as the automatic inheritance of the co-owners estate upon death, is revoked. The property will then be inherited according to the Will of the deceased or, if there is no Will, the Rules of Intestacy.

If you are Proprietors in Common, you can become Joint Proprietors but only if you both/all sign a Declaration of Trust in which you all agree to the creation of a Joint Tenancy.